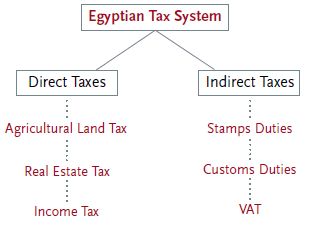

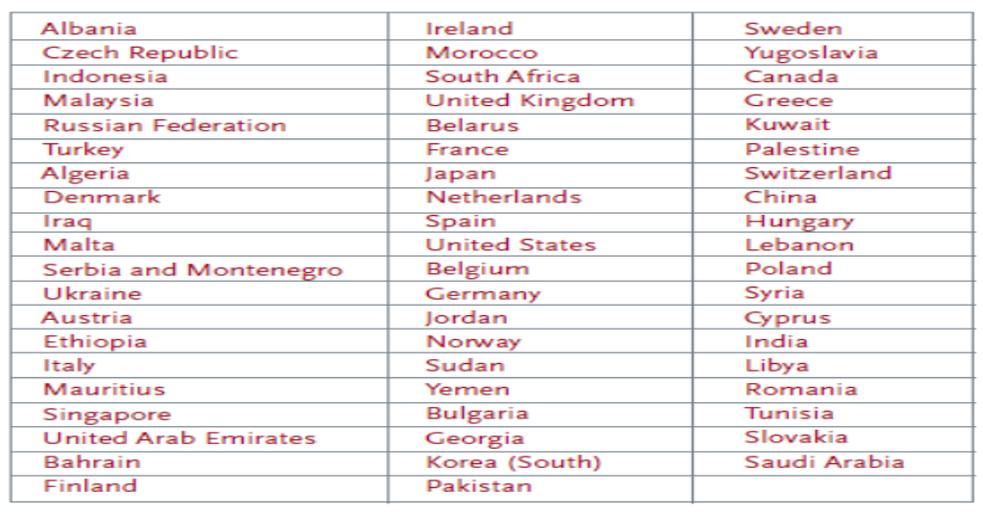

A country’s taxation regime can significantly impact the amount of investment made within it, particularly from foreign investors who may find it more justifiable to do business in their home towns if tax regimes in a particular country are comparatively higher than their domestic tax rates. It is generally accepted that high taxes have an adverse effect on the industry level investment; in particular, high corporate taxes reduce investment by increasing the user cost of capital.With this in mind, there has been a surge to do business in the Middle East in the last decade, where countries offer tax breaks and incentives which are unparalleled in Europe, the USA and Canada. This guide will focus particularly on taxation in Egypt; however, comparisons maybe made with other countries for ease of reference.Today, Egypt offers investors competitive tax rates, with many projects even qualifying for tax breaks for their equipment and land. Furthermore, Egypt has signed double taxation treaties with a large number of countries, making the country all the more appealing as a destination for commercial activity. Although the country does still tax personal income, unlike some of its neighbors, new laws have decreased taxation for the top band of income from 25% to 22.5%, which is significantly lower than countries such as the UK (can reach 45%) and Sweden (can reach 36%).The New Investment Law which was introduced in 2017 also provides a number of incentives and tax deductions particularly for greenfield investments.Egypt introduced its first modern tax laws in 1939 which imposed taxes on business and labor gains (Law No. 14 of 1939) and on agricultural and (Law No. 113 of 1939). The current structure of the Egyptian tax system includes both direct taxes and indirect taxes, as follows:

Salary Income Tax

The tax year here is the calendar year. Income tax is imposed on the total net income of natural persons (resident and nonresident),and applies to salaries and similar remuneration as follows: a- All earnings due to the taxpayer resulting from work with a third party: b- With or without a contract, c- Periodically or non- periodically, Whatever the names, forms or reasons for those earnings, whether they are for (i) works performed in Egypt or (ii) from abroad and paid from a source in Egypt. This includes wages, remunerations, incentives, commissions, grants, overtime, allowances, shares and portions in profits, as well as monetary privileges and allowances.

Taxable Base

The net taxable amount is determined based on the gross salaries (cash and/or in-kind benefits) after deducting the following allowances:

*For items 3 and 4 above, entitlements should not exceed 15% of the net income or EGP 10,000, whichever is less.

The following collective allowance in-kind:

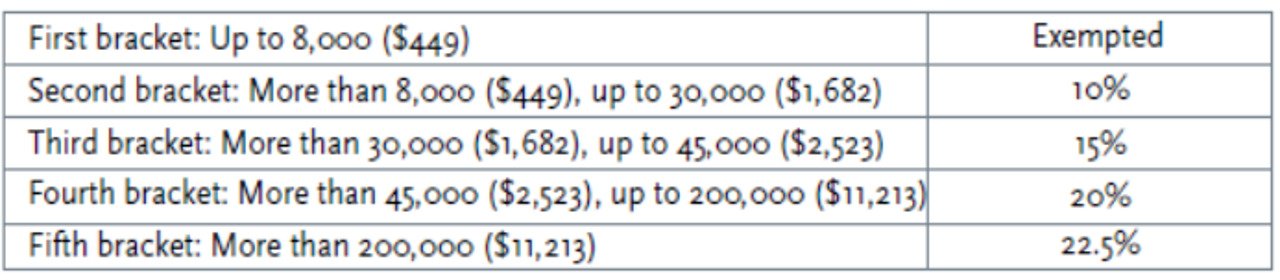

Tax Rates

A tax credit has also been applied as of the 1st July 2018. This tax credit is calculated on the total annual taxable amount (bracket) as follows:

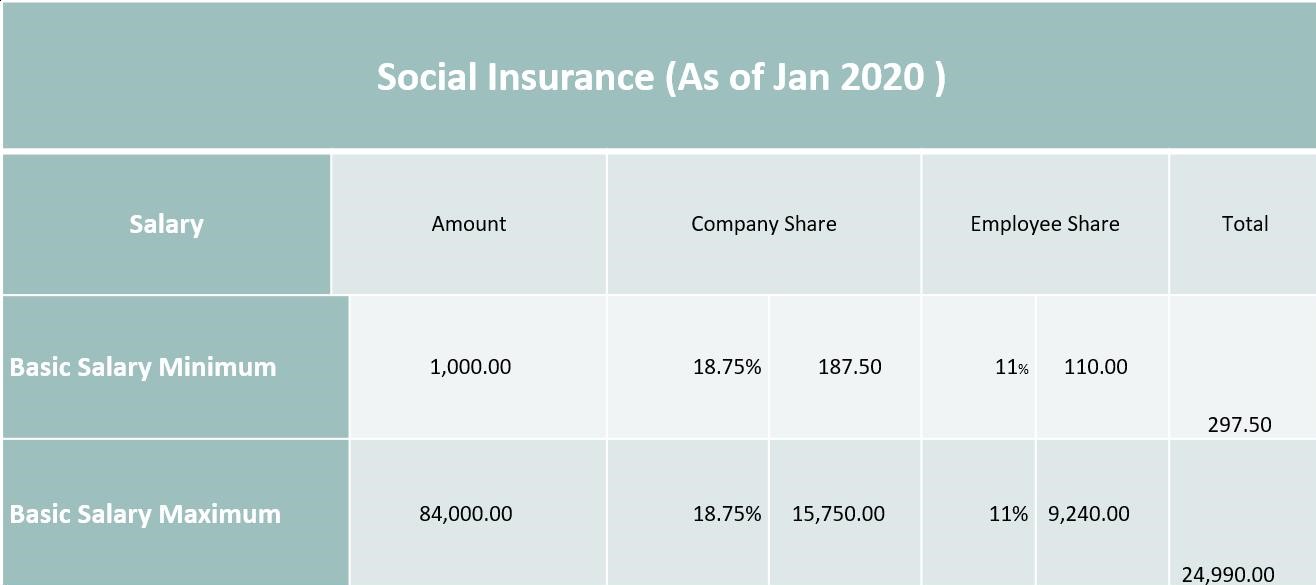

Social Insurance

There are social insurance contribution obligations for both employer and employees as follows (Monthly in EGP):

Withholding Tax

Onshore

A withholding tax, also called a retention tax, is a legal requirement for the payer of an item of income to withhold or deduct tax from the payment and pay that tax to the government instead. Typically the withholding tax is treated as a payment on account of the recipient’s final tax liability. In Egypt, withholding on local payments of a value more than EGP 300 (per invoice) will be applicable, the amount of which will vary depending on the type of activity as follows:

Additionally, amounts paid by sole proprietorships or any legal entities to any natural person as a commission or a brokerage fee that is not relevant to the work performed will also be subject to a 20% tax without any deduction.

Offshore

Tax Rates

For payments made to non-residents for services performed in or outside the country, a standard rate of tax is charged at 20% and is applicable to the following:

Sportsmen or artist activity charges, whether paid directly or through any entity. Withholding tax on payments to non-residents is not applicable for the following services:

If a DTT exists which provides a lower withholding tax rate, the rate within the DTT should be applied.

Despite this, a ministerial decree issued in 2009, coming into effect from the 1st January 2010, highlighted that even if a DTT exists, the resident company should deduct the full 20% and then approach the Egyptian tax authority to refund the difference between the domestic rate and the treaty rate. Starting from the 1st January 2013, free zone companies/projects are also legally obliged to apply withholding tax on non-residents. On September 7th 2016 the Egyptian government implemented a fully-fledged VAT scheme which took over the general sales tax regime previously in place. The Law has become effective as of September 8th2016.

What is VAT

VAT is an attempt to tax businesses at each stage of the supply chain from raw material to a product that is utilized by the consumer. As the good moves up through the supply chain, the tax is charged incrementally by every business that uses the material or product. VAT is applicable to services as well as goods,i.e. hotel stays, restaurant meals, legal advice, and the like.

Tax Rates

Standard VAT rate of 14% applies to most of goods and services. Machinery and equipment used in producing taxable or non- taxable goods or rendering services are subject to a 5% VAT. Exported goods and services are subject to a 0% VAT. Certain products are subject to different rates/ amount per unit (excise tax), and certain products and services are subject to both excise tax and the VAT.

Registration Threshold

Any individual or juridical person who sold taxable goods or services during the 12 months prior to the 7th September 2016 with a turnover of at least EGP 500,000 (equivalent to US$ 28,250) must register for the VAT within 30 days. Voluntary registration is allowed for individual/ juridical persons who have not yet reached this threshold.

VAT Returns

A monthly return should be filed for the VAT and/ or the excise (table) tax due within two months following the tax accounting month, except for April which should be filed no later than 15 June each year. The return must be filed even if no sales are made within the tax period. If the tax return is not filed before the deadline, the Egyptian Tax Authority has the right to make their own assessment.

Tax Deduction

These can be made for input tax. Input tax is the VAT incurred or charged to the registrant when he purchases or imports goods and services, directly or indirectly related to the sale of goods and services subject to VAT. When calculating the tax, the following should be deducted from the tax due on the sales value:

Reverse Charge

These are applicable to services rendered by those who do not reside in Egypt.

If a non-resident person not registered with the ETA renders a taxable service to a person not registered in Egypt:

In this scenario, the service provider must appoint a representative to fulfill his TAX duties including registration, payment of VAT, the additional tax and any other taxes due according to the law.

OR

Egyptian residents receiving the service will have to fulfill these obligations for him without breaching his right to reimburse the tax payments made from the nonresident service provider later.

Nonresident person, not registered with the ETA renders a service to:

Stamp Duty Tax

Stamp tax by law number 111 of 1980 and its amendment, and as of August 2006, the major stamp taxable amounts are as follows:

Proportional stamp duty will also be imposed on the purchase or sale of all securities, regardless of whether such securities are Egyptian or foreign, listed or unlisted, without deducting any costs as follows:

Other Tax Matters

Egyptian tax law contains specific tax provisions relating to transfer pricing based on the arm's length principle starting from the issuance of the income tax law No. 91 of 2005. The tax authorities may adjust the income of an enterprise if its taxable income in Egypt is reduced as a result of contractual provisions that differ from those that would be agreed upon by unrelated parties. However, according to Egyptian tax law, it is possible to enter into arrangements in advance with the tax department regarding a transfer pricing policy (advance pricing agreement(APA)). An APA ensures that transfer prices will not be challenged after the tax return is submitted and, accordingly, eliminates exposure to penalties and interest on the late payment of taxes resulting from adjustments of transfer prices. The ETA, in association with the OECD, has issued Transfer Pricing Guidelines. These guidelines advise the taxpayers on the application of the arm’s-length principle in pricing their intragroup transactions, as well as outlining the documentation taxpayers should maintain as evidence to demonstrate their compliance with the arms-length principle. In 2016, Egypt signed the Base Erosion & Profit Shifting (BEPS) inclusive framework to be BEPS associate country by signing; Egypt is committing to applying the four minimum action plan standards per BEPS as follows: Action 5 - Harmful tax practices, Action 6 - Treaty abuse, Action 13 - Country by Country Reporting(CbCR) & Action 14 - Dispute resolution N.B: Egypt has not yet signed the exchange of information agreements on CbCR or mutual administrative assistance on tax matters.

Egypt has a free market exchange system. Exchange rates are determined by supply and demand, without interference from the Central Bank or the Ministry of Finance.

The Egyptian tax law includes thin-capitalization rules with respect to the deduction of interest on loans, which applies if the debt-to-equity ratio exceeds 4:1. The ratio applies to all debts owed to related and unrelated parties as well as to loans obtained from financial institutions. The limitation does not apply however, to banks and insurance and leasing companies. In case the debt exceeds such a ratio, then the excess interest would not be considered a tax-deductible cost.